what does liquidating stock mean

Remember a liquidation can only happen in a. Liquidation results in the.

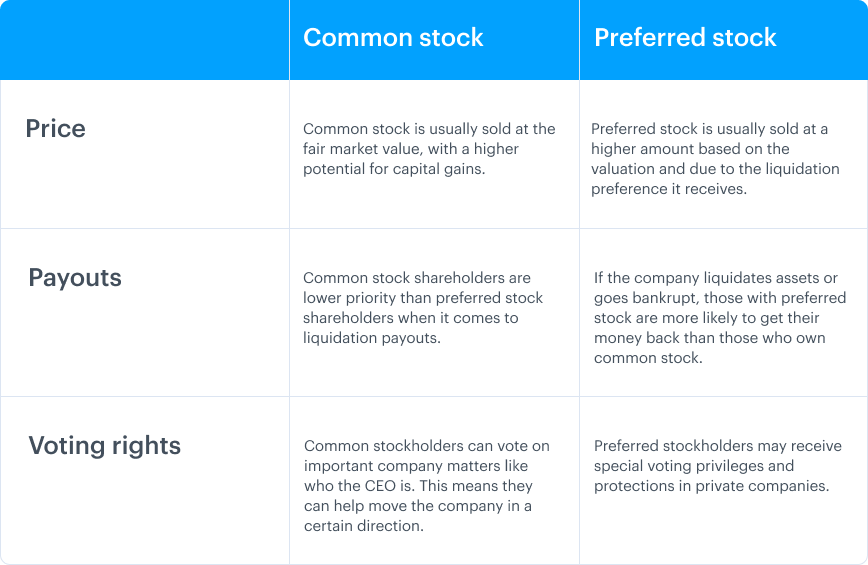

Common Stock Vs Preferred Stock Key Differences Carta

For example you own a share of Reliance Industry which.

. The term liquidate is defined as the act of converting your assets into cash. A stock liquidation occurs when stock shares are converted into cash. A liquidating order involves the sale of a contract that has been purchased or purchase of a contract that has been sold.

Stocks with higher liquidity will. Due to the risk associated with leverage trading some. Liquidating trade means atransaction whereby for the purpose of closing out a futures contract the person in the bought position or sold position under the futures contract assumes an.

What does company liquidation mean. The companys last stock split was on a. The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just.

Liquidity in stocks is defined as the degree to which a stock can be bought or sold without impacting its price. What does it mean when a stock is liquidating. Liquidating a stock means selling it for cash.

The shares are to be split on a 3-for-1 basis meaning investors will receive an additional two shares for each one they already own. Answer 1 of 8. The term liquidation means the process of selling an asset in return of its monetary value at the time of sale.

An order to close out an existing open futures or options contract. This is usually done by selling the possessed assets and in return getting cash. To liquidate means to sell an asset for cash.

This means if bitcoins price falls so too does the amount of funds held in collateral resulting in faster liquidations. With common stock dividends are not fixed. In most instances stock liquidation occurs when shareholders sell their shares on the open market.

In finance and economics liquidation is an event that usually occurs when a company is insolvent meaning it cannot pay its obligations as and when they come. The liquidation price is the distance from the entry price of your leveraged position to where it gets liquidated. Investors may choose to liquidate an investment for a variety of reasons.

In most cases it is. What does stock liquidity mean. Lets assume that a preferred stock requires a monthly 025 dividend payment and that there is a six percent required rate of return each.

Liquidation is the process of converting a companys assets into cash and using those funds to repay as much as possible the companys debts. When a company goes into liquidation its assets are sold to repay creditors and the business closes down.

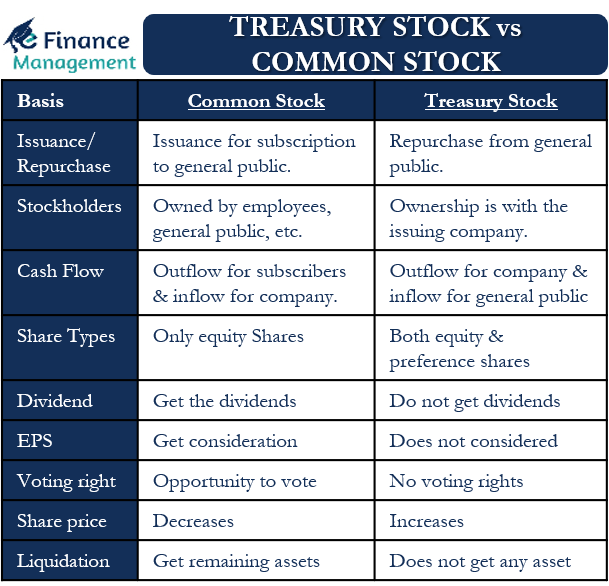

Treasury Stock Vs Common Stock Meaning Differences And More Efm

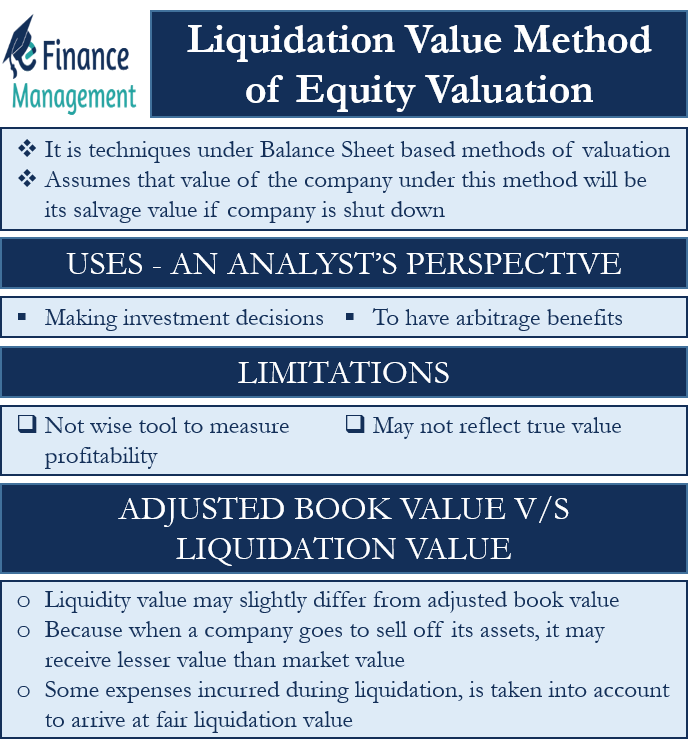

Liquidation Value Why It Might Be The Best Valuation Technique

Liquidating Old And Surplus Inventory 11 Smart Ways To Get Rid Of Excess Stock Vend Retail Blog

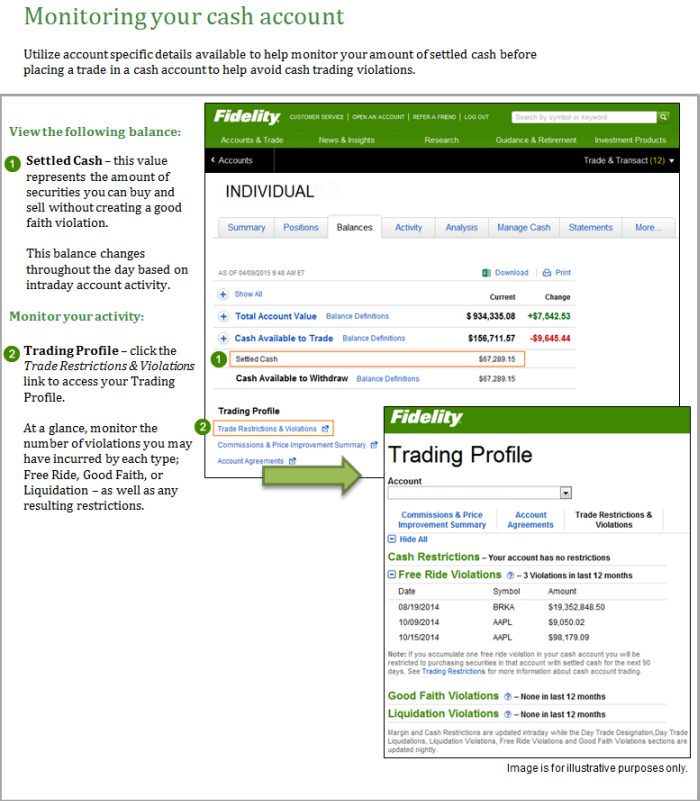

Avoiding Cash Account Trading Violations Fidelity

How Net Liq Is Calculated On Tastyworks Tastyworks

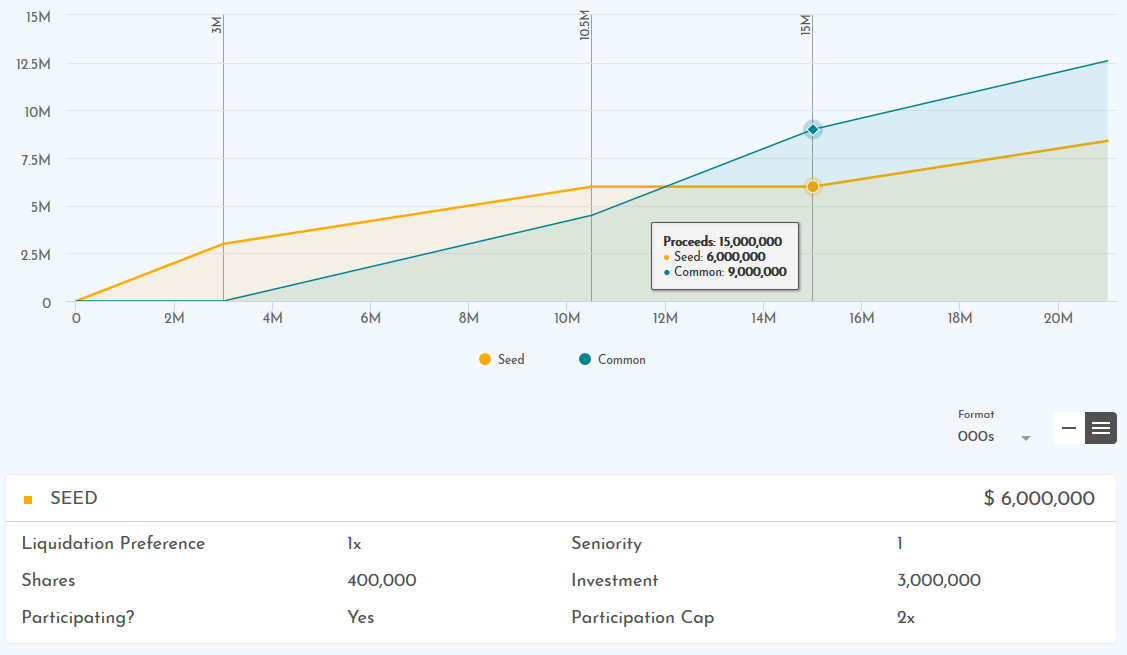

What Is Liquidation Preference Why It S Important Propel X

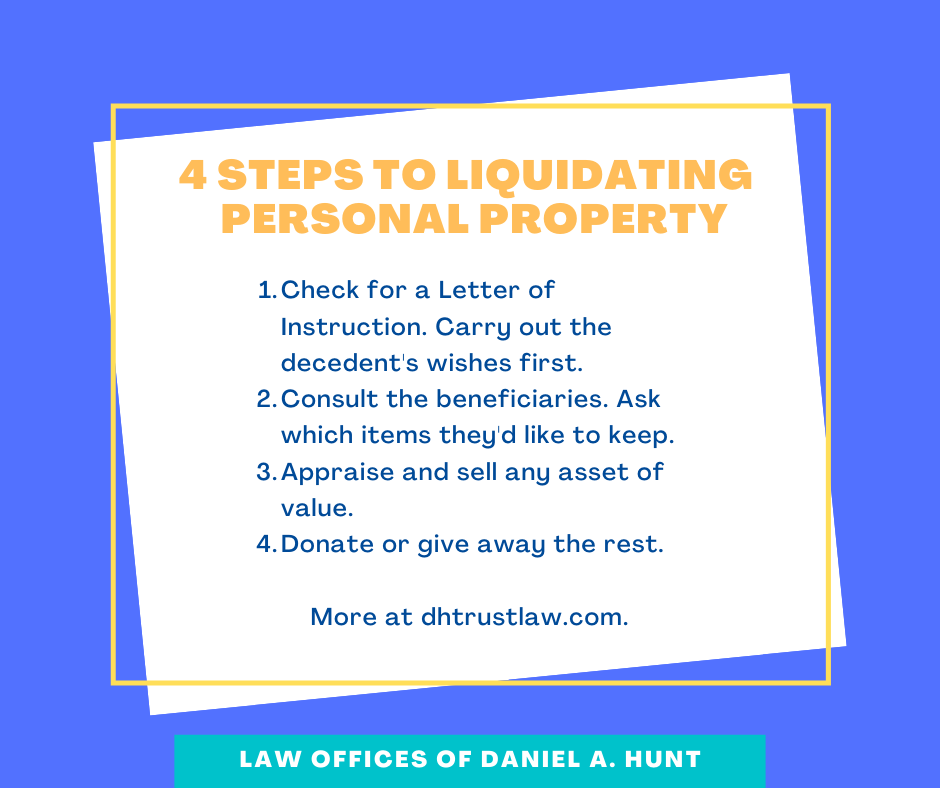

How To Liquidate Assets Post Death Law Offices Of Daniel A Hunt

Understanding Startup Equity And Option Value In The Face Of Liquidation Preferences

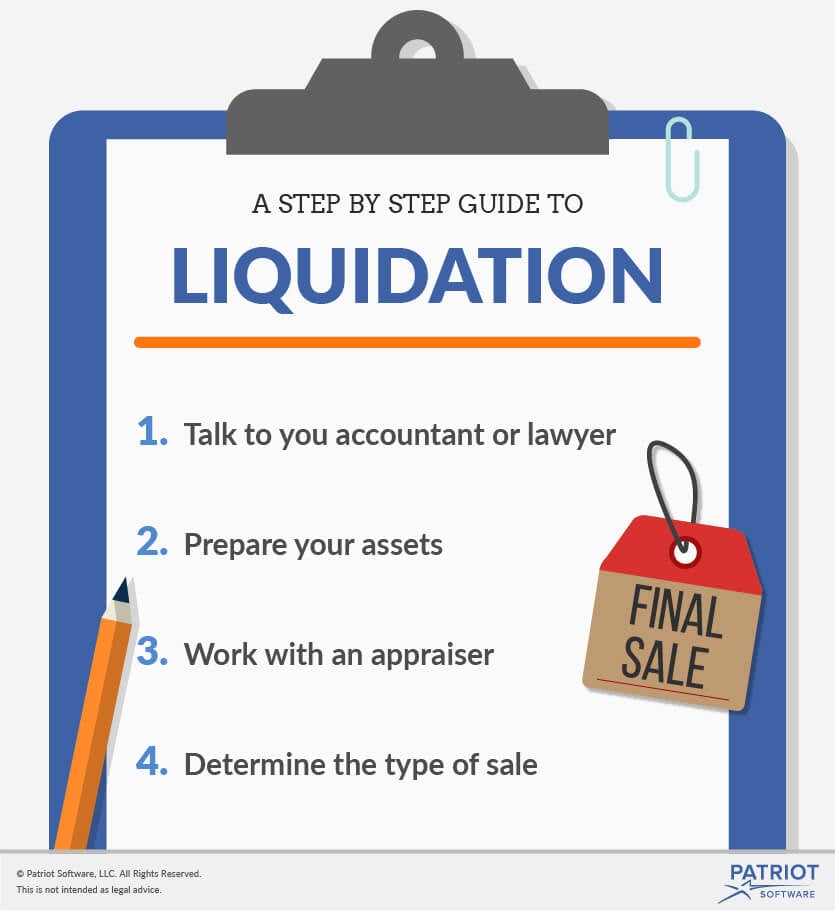

Small Business Liquidation What Is Liquidation In Business

Investors Education What Is A Stock Webull

How To Use Self Liquidating Offers In Your Facebook Ads Social Media Examiner

What Is A Liquidation Waterfall Venture Capital Fundwave Blogs

Participating Preferred Stock Wikipedia

Chapter 7 Bankruptcy Liquidation Video Khan Academy

What Is Capitulation In The Stock Market Definition Examples Thestreet

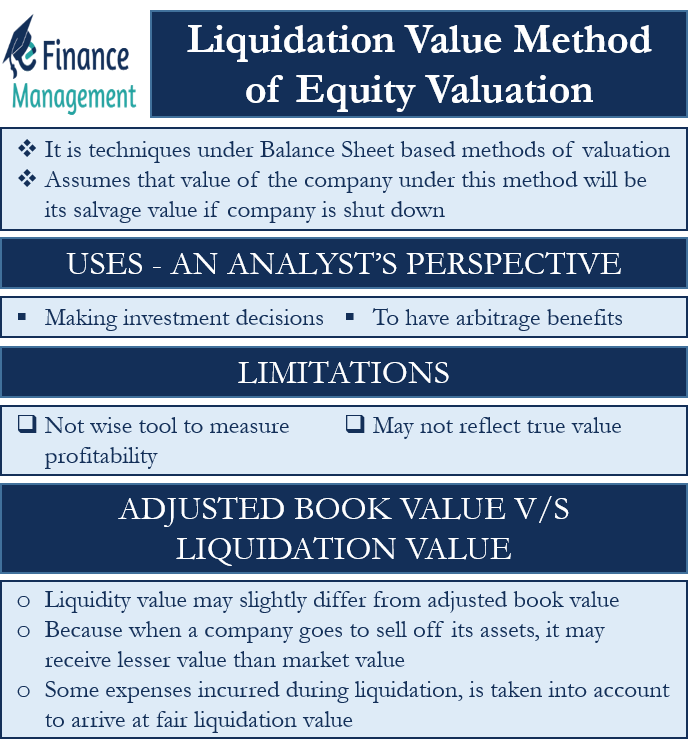

Liquidation Value Method Of Equity Valuation Uses Limitation Comparison